Are you a remote worker? If so, you’re probably spending a lot of time at home. More specifically, you’re spending a lot of time in your home office. Conducting day-to-day business activities from home requires a lot of investment to make your home work-ready. A lot of the financial burden of updating spaces to work from home might be falling on you. Thankfully, there are ways to get rid of some of that financial stress. In most situations, you can start deducting those expenses from your taxes or even better, have your employer reimburse you!

When thinking about purchasing items for your home office, there are three things you need to know: your legal rights, your company’s reimbursement policies, and the cost and purpose of your item.

Types of Work-Related Expenses for your Home

There are two distinct types of work-related expenses you will encounter while building and maintaining your remote workspace. Firstly, you have essential home office expenses. These expenses are critical to completing your assigned responsibilities and duties. Secondly, there are nice-to-have home office expenses that while not critical to your work, can dramatically improve your well-being and productivity.

Essential Home Office Expenses

The following items are examples of essential items to create a workable office space at home.

- Home Internet

- Business Phones

- Computer

- Mouse

- Keyboard

- Desk

- Chair

- Office Supplies (Notepads, Pens and Pencils)

Nice-to-Have Home Office Expenses

The following items are examples of home office supplies that are not essential to conducting business.

- External Webcam

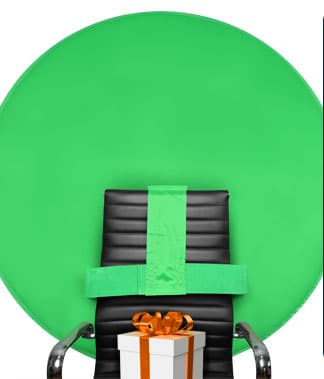

- Webaround

- Headphones

- Laptop Stand

While your employer may not reimburse you for these items, there are tax deductions that you can claim when investing in your home office.

Home Office Reimbursement Employer Responsibilities

The federal Fair Labor Standards Act (FLSA) generally does not require employers to reimburse home-office expenses accrued by employees. The exception is that the FLSA does apply to employer reimbursements when the worker’s earnings fall beneath the minimum wage. Additionally, there are states that do go above federal standards and have statutes related to business reimbursement standards.

- California,[1]

- District of Columbia,[2]

- Illinois,[3]

- Iowa,[4]

- Massachusetts,[5]

- Minnesota,[6]

- Montana,[7]

- New Hampshire,[8]

- New York,[9] and

- Pennsylvania [10]

Different states have different standards. To learn more about the specifics of your state, please refer to your individual state’s statutes.

Taxes and Home Office Deductions

According to the IRS, you may be able to deduct expenses for the business use of your home. How do you know if you qualify for these types of deductions?

Requirements for Home Office Tax Deductions

The following home office tax deduction requirements are outline by the IRS. These requirements must be met in order to qualify for a home office tax deduction.

Regular and Exclusive Use

You need to a use part of your home exclusively and regularly to conduct your business. For example, if you have an extra room that you use as your office, you are complying with the regular and exclusive use requirement.

Principal Place of Your Business

You must also show that your home is the place where you most-often conduct business. However, if you do business outside of your home but regularly use your home for office purposes, you may qualify for the deduction.

Generally, these types of deductions are based on the square footage percentage of your home that you use for business purposes. If you use a specific space within a room that doubles for another purpose, you will need to calculate the square footage used exclusively for business.

Types of Deductions Available

Simplified Option for Home Deduction

As of January 1st, 2013 (2014 filing year), you can use the Simplified Option for Home Deduction to calculate the amount for which you qualify. Here are a few highlights of the simplified option for home deduction option, according to the IRS.

Highlights of the simplified option:

- Standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

- Allowable home-related itemized deductions claimed in full on Schedule A. (For example: Mortgage interest, real estate taxes).

- No home depreciation deduction or later recapture of depreciation for the years the simplified option is used.

Regular Deduction Method

You can also use the regular deduction method for calculating your home office deduction. This type of deduction does require you to track and determine the actual expenses you’ve incurred for your home office. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation.

Check Employer Reimbursement Policy

The last important part to understanding how to lessen the financial impact associated with building a home office is learning about your employer’s reimbursement policy. These policies generally outline what qualifies as expenses including the amount that you can spend on items. Employer policies will vary and not all employers will have one. But, generally, if your employer has a reimbursement policy, it will likely include some or all of these options:

- One-time budget allowance provided to employee to cover all costs associated with home office. Employee gets to choose equipment as long as he or she stay within budget.

- Stipend for recurring expenses such as home internet, office phone, etc.

- Manager approved purchases. An employee can purchase items eligible for reimbursement as long as item and price is approved prior to purchase by manager.

Summary

Whether you’re deducting or having your professional expenses reimbursed, you can lighten up the financial burden required to set up a workable and productive office space in your home. To get started, all you need to do is know your legal rights, prepare your deduction plan ahead of tax season, and leverage your employer’s reimbursement policy as best you can. With less money out of pocket on your home office, you can allocate more to your personal expenses.